- Get link

- X

- Other Apps

Defaulting on a private student loan can have serious consequences and understanding what happens in such a scenario is crucial. Private student loans are different from federal loans and defaulting on them can lead to a series of financial and legal complications. In this article, we will explore the consequences of defaulting on a private student loan, the steps involved in the process, and potential solutions to mitigate the impact.

It is important to note that defaulting on any loan, including private student loans, should be avoided at all costs. However, unforeseen circumstances can sometimes make it difficult for borrowers to meet their repayment obligations. This article aims to provide guidance and information to help borrowers navigate the complexities of defaulting on a private student loan.

What Does Defaulting on a Private Student Loan Mean?

Defaulting on a private student loan occurs when a borrower fails to make payments for a specified period, usually 120 days. This failure to repay the loan as agreed upon in the loan agreement triggers a default. Once a loan is in default, the lender can take legal action to collect the remaining balance and interest.

Defaulting on a private student loan can have immediate and long-term consequences for borrowers. It is essential to understand the specific implications to make informed decisions moving forward.

Immediate Consequences of Defaulting

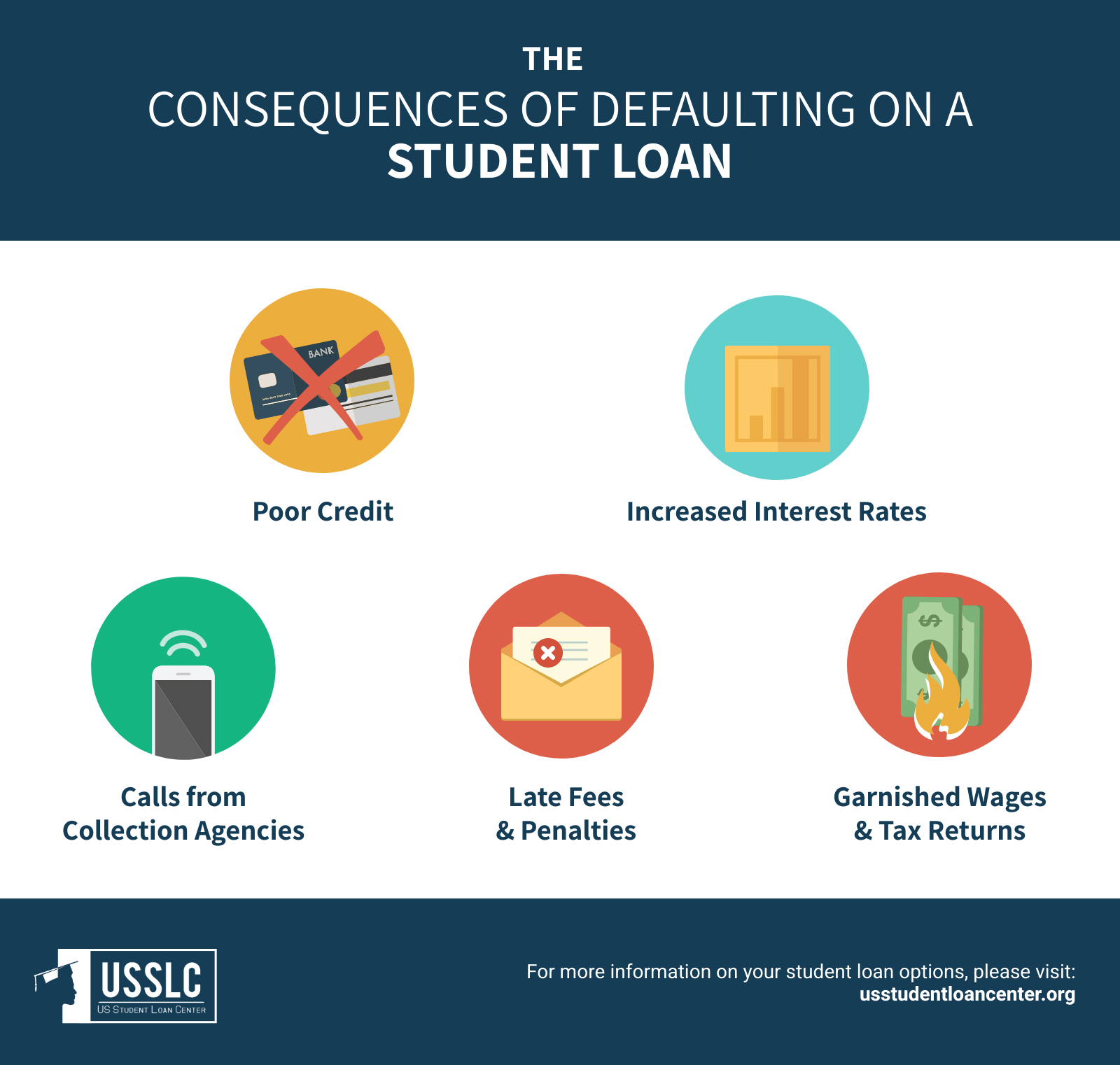

When a borrower defaults on a private student loan, several immediate consequences can occur. These consequences can have a significant impact on the borrower's financial situation and creditworthiness. It is crucial to be aware of these immediate repercussions to take appropriate action.

One of the immediate consequences of defaulting on a private student loan is that the lender can accelerate the loan, meaning the entire remaining balance becomes due immediately. This can make the debt even more challenging to manage, especially if the borrower is already struggling with financial difficulties.

Additionally, defaulting on a private student loan can result in the loan being sent to collections. Collection agencies may contact the borrower through various means, such as phone calls and letters, in an attempt to collect the outstanding debt. These collection efforts can be stressful and intrusive, causing further distress to the borrower.

Furthermore, defaulting on a private student loan can have severe consequences for the borrower's credit score. Late payments and default are reported to credit bureaus, resulting in a significant drop in the borrower's credit score. This can make it more challenging to secure future credit opportunities, such as loans, credit cards, or even rental agreements.

It is crucial to be aware of these immediate consequences and take proactive steps to address the defaulted loan to minimize the impact on your financial well-being.

Legal Actions Taken by Lenders

Once a private student loan defaults, lenders have legal options to collect the outstanding debt. Understanding these legal actions is essential for borrowers to be prepared and aware of their rights and responsibilities.

One of the legal actions that lenders can take when borrowers default on their private student loans is filing a lawsuit. This legal action aims to obtain a judgment against the borrower, allowing the lender to legally enforce collection efforts. If the lender is successful in the lawsuit, they may be granted a judgment that enables them to garnish the borrower's wages or place a lien on their property.

Another legal action that lenders can take is obtaining a judgment against the borrower. This judgment allows the lender to have a legal claim on the borrower's assets, such as bank accounts or real estate. The lender can then use these assets to recover the outstanding debt.

In some cases, lenders may also engage debt collectors to assist in the collection efforts. Debt collectors are third-party agencies hired by the lender to pursue payment on defaulted loans. These collectors may employ various tactics to recover the debt, including phone calls, letters, and even potential legal action.

It is important for borrowers to understand their rights when faced with legal actions by lenders. Seeking legal advice and understanding the applicable laws can help borrowers navigate this challenging situation.

Impact on Credit Score and Credit History

Defaulting on a private student loan can have a severe impact on a borrower's credit score and credit history. This can significantly affect the borrower's ability to secure future credit opportunities and may have long-lasting consequences.

When a borrower defaults on a private student loan, the late payments and default are reported to credit bureaus. This negative information remains on the borrower's credit report for several years, depending on the credit reporting agency's policies. The default can lower the borrower's credit score, making it more challenging to qualify for loans, credit cards, or favorable interest rates.

In addition to the negative impact on credit scores, defaulting on a private student loan can also lead to other negative marks on the borrower's credit report. For example, if the lender takes legal action and obtains a judgment against the borrower, this judgment will be reported on the credit report, further damaging the borrower's credit history.

The long-term consequences of a damaged credit score and credit history can extend beyond borrowing. Employers, landlords, and insurance companies often check credit reports when making decisions. A negative credit history resulting from defaulting on a private student loan can hinder employment opportunities, rental applications, and even insurance rates.

Understanding the impact defaulting can have on credit scores and credit history is crucial for borrowers to take appropriate action and protect their financial future.

Collection Efforts by Loan Servicers

After default, loan servicers may employ various collection tactics to recover the outstanding debt. These collection efforts can be both persistent and distressing for borrowers. It is important to understand the common collection efforts employed by loan servicers and your rights as a borrower.

One of the primary collection efforts by loan servicers is making repeated phone calls to the borrower. These calls can become intrusive and overwhelming, causing stress and anxiety. It is important for borrowers to know their rights and understand that they have the right to request that the loan servicer communicates with them in writing rather than over the phone.

Loan servicers may also send letters to borrowers, demanding payment and outlining the consequences of default. These letters may provide information on potential legal actions, such as lawsuits or wage garnishment, and may urge borrowers to take immediate action to resolve the defaulted loan.

In some cases, loan servicers may engage third-party debt collectors to assist in the collection efforts. Debt collectors are separate entities from the original lender or loan servicer and may use more aggressive tactics to collect the debt. These tactics can include additional phone calls, threats, or even misrepresentation of the consequences of default.

It is essential for borrowers to be aware of their rights when dealing with collection efforts. The Fair Debt Collection Practices Act (FDCPA) provides guidelines and protections for borrowers when interacting with debt collectors. Understanding these rights can help borrowers navigate this challenging situation and protect themselves from abusive or illegal collection practices.

Repayment Options for Defaulted Loans

Despite defaulting on a private student loan, borrowers still have options to resolve their debt. These repayment options can provide a path towards regaining control of their financial situation and working towards resolving their defaulted loans.

One potential repayment option for defaulted loans is loan rehabilitation. Loan rehabilitation allows borrowers to make a series of agreed-upon payments over a set period to demonstrate good faith and commitment to repaying the debt. Successful completion of the rehabilitation program can result in the removal of the default status from the borrower's credit report.

Another option for borrowers is loan consolidation. Loan consolidation involves combining multiple loans into a single new loan, often with a new servicer. Consolidation can provide borrowers with a simplified repayment plan and potentially lower monthly payments. However, it is important to note that consolidation may not remove the default status from the borrower's credit report.

Additionally, borrowers may have the option to negotiate a settlement with the lender or loan servicer. This involves reaching an agreement to settle the debt for less than the full amount owed. However, it is essential to approach settlement negotiations with caution and seek professional advice, as they can have long-term implications on credit and tax liability.

Exploring these repayment options and understanding their implications can help borrowers make informed decisions and take the necessary steps towards resolving their defaulted loans.

Rehabilitation vs. Consolidation

When considering repayment options for defaulted loans, borrowers often come across the terms "rehabilitation" and "consolidation." Understanding the differences between these options is crucial in making an informed decision that aligns with your financial goals and circumstances.

Loan rehabilitation involves making a series of agreed-upon payments over a set period, typically nine months. These payments are based on the borrower's income and expenses, ensuring they are affordable. Successful completion of the rehabilitation program can result in the removal of the default status from the borrower's credit report, potentially improving their creditworthiness.

On the other hand, loan consolidation involves combining multiple loans into a single new loan, often with a new servicer. Consolidation can provide borrowers with a simplified repayment plan, as they only have one loan to manage and one monthly payment. However, it is important to note that consolidation may not remove the default status from the borrower's credit report.

When deciding between rehabilitation and consolidation, borrowers should consider factors such as their financial situation, credit goals, and long-term repayment plans. Seeking advice from a financial professional or a student loan counselor can help borrowers make the most appropriate decision for their specific circumstances.

Seeking Legal Assistance

Defaulting on a private student loan can be overwhelming, and some borrowers may find it necessary to seek legal assistance. Consulting an attorney who specializes in student loan matters can provide borrowers with valuable guidance and support throughout the process.

When considering legal assistance, it is important to seek help at the right time. If you are facing collection efforts, lawsuits, or other legal actions, consulting an attorney can help protect your rights and ensure you are aware of all available options.

An attorney can review your loan documents and financial situation to provide personalized advice on the best course of action. They can help you understand the legal implications, negotiate with lenders or loan servicers, and represent you in court if necessary. Having professional legal guidance can significantly reduce stress and improve your chances of reaching a favorable resolution.

When seeking legal assistance, it is important to find an attorney who specializes in student loan matters. They should have experience and knowledge in dealing with private student loan defaults and the associated legal complexities. Research and seek recommendations from trusted sources to find a qualified attorney who can effectively advocate for your rights and help you navigate the legal challenges.

Potential Consequences on Co-Signers

When a borrower defaults on a private student loan, the consequences may extend to co-signers. Co-signers are equally responsible for the loan and may face legal and financial ramifications if the primary borrower defaults.

If the borrower defaults, the lender can pursue collection efforts against both the borrower and the co-signer. This means that the co-signer may be subject to the same legal actions, such as lawsuits or wage garnishment, as the primary borrower.

Furthermore, defaulting on a private student loan can have a significant impact on the co-signer's credit score and credit history. Late payments and default are reported to credit bureaus for both the borrower and the co-signer. This can damage the co-signer's creditworthiness and hinder their ability to secure future credit opportunities.

It is crucial for co-signers to be aware of the potential consequences and communicate openly with the primary borrower. Both parties should work together to explore potential solutions, such as loan rehabilitation, consolidation, or negotiating a settlement, to address the defaulted loan and protect their financial well-being.

Rebuilding Credit After Default

Recovering from a defaulted private student loan and rebuilding credit is a challenging process. However, it is not impossible. With dedication and a strategic approach, borrowers can work towards improving their creditworthiness and securing a better financial future.

One of the first steps in rebuilding credit after default is to establish a solid budget. Creating a realistic budget can help borrowers manage their finances effectively, ensuring that they can make timely payments towards their debts and avoid further default.

Additionally, borrowers should make every effort to make timely payments on all their debts. Paying bills on time demonstrates financial responsibility and can help improve creditworthiness over time. Setting up automatic payments or reminders can be useful in ensuring payments are made promptly.

Monitoring credit reports regularly is also essential. Checking credit reports allows borrowers to identify any errors or inaccuracies that may be negatively impacting their credit score. Disputing these errors and ensuring that credit reports reflect accurate information can help improve creditworthiness.

Lastly, it is important to be patient and persistent in rebuilding credit. Rebuilding credit takes time, and there are no quick fixes. By consistently making responsible financial decisions, managing debt effectively, and practicing good credit habits, borrowers can gradually improve their creditworthiness and regain control of their financial future.

Remember, preventing default should always be the primary goal. However, if circumstances beyond your control lead to default, don't lose hope. With the right knowledge and proactive approach, you can work towards resolving your defaulted private student loans and rebuilding your financial future.

Comments

Post a Comment