- Get link

- X

- Other Apps

Are you a veteran or an active-duty service member dreaming of owning your own home? A preapproval VA home loan can help make that dream a reality. In this comprehensive guide, we will walk you through everything you need to know about preapproval VA home loans, from understanding the process to the benefits they offer. So, let's dive in and explore how you can secure your dream home with a VA preapproval!

What is a Preapproval VA Home Loan?

For veterans and service members, a preapproval VA home loan is a valuable tool that allows them to purchase a home with favorable terms and conditions. Under the VA home loan program, the Department of Veterans Affairs guarantees a portion of the loan, making it easier for lenders to offer more favorable terms to borrowers. Unlike traditional home loans, preapproval VA home loans have specific eligibility requirements that are tailored to the needs of veterans and service members.

Eligibility Requirements

To be eligible for a preapproval VA home loan, you must meet certain criteria set by the Department of Veterans Affairs. These requirements include serving a minimum period of active duty, being discharged under honorable conditions, and obtaining a Certificate of Eligibility (COE) from the VA. The COE verifies your eligibility for a VA loan and serves as proof to lenders that you are entitled to VA home loan benefits.

Advantages of Preapproval VA Home Loans

One of the key advantages of a preapproval VA home loan is the ability to purchase a home with little to no down payment. While conventional loans typically require a down payment of 10% to 20% of the home's purchase price, VA loans often allow eligible borrowers to buy a home with no down payment at all. This can significantly reduce the upfront costs associated with buying a home and make homeownership more accessible for veterans and service members.

Another major benefit of preapproval VA home loans is the flexibility they offer in terms of credit score requirements. While conventional loans usually require a higher credit score to qualify, VA loans have more lenient credit score guidelines. This means that even if you have less-than-perfect credit, you may still be eligible for a preapproval VA home loan. This flexibility can be a game-changer for veterans and service members who may have faced financial challenges during their service.

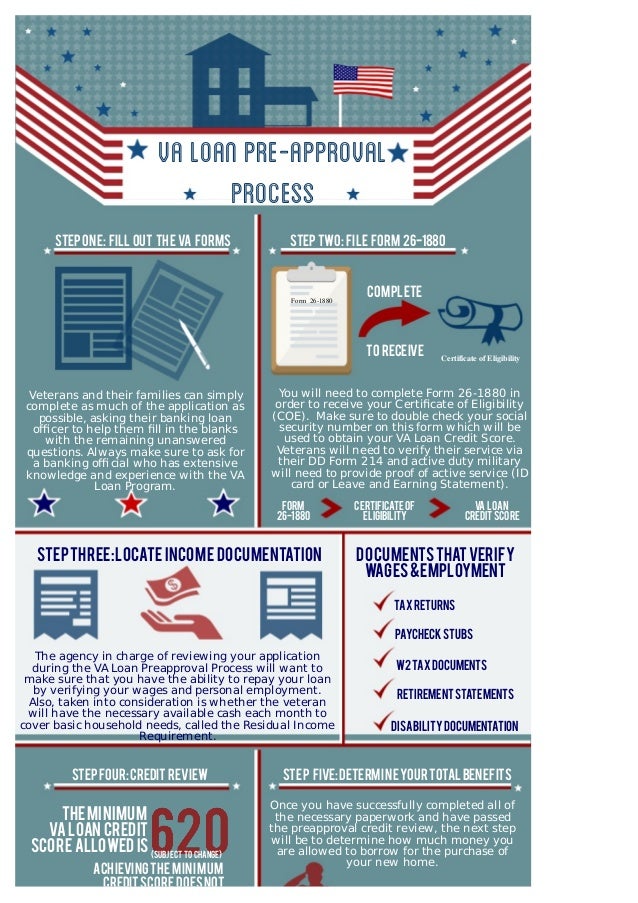

The Preapproval Process

Obtaining a preapproval for a VA home loan involves several steps that are essential to ensure a smooth and successful process. By understanding and following these steps, you can increase your chances of securing a preapproval and moving closer to your dream of homeownership.

Gather Your Documents

Before you begin the preapproval process, it's crucial to gather all the necessary documents. This includes your Certificate of Eligibility (COE), proof of income (such as pay stubs or tax returns), and documentation of your assets and debts. Having these documents ready will streamline the application process and help lenders assess your eligibility more efficiently.

Find a VA-Approved Lender

To apply for a preapproval VA home loan, you'll need to work with a lender that is approved by the VA. VA-approved lenders have experience in handling VA loans and can guide you through the process. Research reputable lenders in your area and compare their rates, fees, and customer reviews to find the best fit for your needs.

Submit Your Application

Once you've gathered all the necessary documents and chosen a VA-approved lender, it's time to submit your application for preapproval. The lender will review your documentation, assess your creditworthiness, and determine the loan amount you qualify for. This process may involve a thorough examination of your financial history and credit score, so it's essential to be prepared and provide accurate information.

The Importance of Responsiveness

During the preapproval process, it's crucial to be responsive and promptly provide any additional information or documentation requested by your lender. Timely communication and cooperation can help expedite the process and demonstrate your commitment to obtaining a preapproval VA home loan. Stay in close contact with your lender and be prepared to address any queries or concerns they may have.

Understanding VA Appraisals and Inspections

One of the critical steps in the preapproval process is the VA appraisal and inspection. These assessments play a vital role in ensuring the property meets the VA's safety and quality standards.

VA Appraisal

A VA appraisal is an evaluation of the property's value conducted by a certified VA appraiser. The appraiser assesses various factors, such as the property's condition, location, and comparable sales in the area, to determine its fair market value. This appraisal is crucial as it helps protect both the borrower and the lender by ensuring the property is worth the amount being financed.

VA Inspection

In addition to the appraisal, a VA inspection is also required to identify any potential issues with the property's safety or habitability. The inspector will thoroughly examine the property's structure, electrical systems, plumbing, and other important aspects to ensure it meets the VA's minimum property requirements. This inspection helps ensure that veterans and service members are not purchasing a property with hidden defects or hazards.

Loan Limits and Entitlements

Understanding the loan limits and entitlements associated with preapproval VA home loans is crucial for determining the maximum loan amount you can borrow.

Loan Limits

VA loan limits vary by county and are based on the Federal Housing Finance Agency's conforming loan limits. These limits determine the maximum loan amount the VA will guarantee without requiring a down payment. It's important to research the loan limits in your area to determine the maximum loan amount you can obtain through a preapproval VA home loan.

Entitlements

VA loan entitlements are the amount the VA will guarantee on your behalf. There are two types of entitlements: basic and bonus. The basic entitlement is $36,000, and the bonus entitlement (also known as the second-tier entitlement) is an additional amount that can vary depending on the loan limit in your county. Understanding your entitlements is crucial for determining the loan amount you can borrow without a down payment.

Additional Costs and Fees

While preapproval VA home loans offer numerous benefits, it's important to consider the additional costs and fees associated with these loans.

Funding Fee

One of the most significant costs associated with a preapproval VA home loan is the funding fee. The funding fee is a one-time payment that helps offset the costs of the VA loan program. The fee can vary depending on factors such as your military service category, down payment amount, and whether it's your first or subsequent use of a VA loan. It's important to include the funding fee in your calculations when determining the total cost of your VA loan.

Closing Costs

Similar to traditional home loans, preapproval VA home loans involve closing costs. These costs include fees for services such as the appraisal, credit report, title search, and loan origination. While VA regulations limit the closing costs that veterans and service members can pay, it's essential to budget for these expenses to avoid any surprises during the closing process.

Other Potential Fees

In addition to the funding fee and closing costs, there may be other potential fees associated with your preapproval VA home loan. These can include fees for document preparation, underwriting, and recording. It's crucial to review the loan estimate provided by your lender, which outlines all the associated fees, to fully understand the financial obligations of your VA loan.

Tips for a Successful Preapproval Process

Navigating the preapproval process for a VA home loan can be made easier with these valuable tips and advice:

Improve Your Credit Score

While VA loans have more flexible credit score requirements, improving your credit score can still help you secure better terms and rates. Take steps to pay off any outstanding debts, make payments on time, and avoid new credit inquiries during the preapproval process to increase your chances of approval.

Organize Your Financial Documents

Having all your financial documents organized and readily available will streamline the preapproval process. Gather documents such as pay stubs, tax returns, bank statements, and proof of assets and debts in a single folder. This will make it easier for your lender to review your financial history and assess your eligibility.

Choose the Right Lender

Research and compare VA-approved lenders to find the best fit for your needs. Look for lenders with experience in VA loans, competitive rates, and excellent customer reviews. A lender who understands the unique aspects of VA loans can guide you through the process and help you secure the best terms and conditions.

Be Responsive and Cooperative

During the preapproval process, be responsive and promptly provide any additional information or documentation requested by your lender. Timely communication and cooperation can help expedite the process and demonstrate your commitment to obtaining a preapproval VA home loan. Stay in close contact with your lender and be prepared to address any queries or concerns they may have.

Frequently Asked Questions

Here are some commonly asked questions about preapproval VA home loans:

Eligibility Requirements

1. Can I qualify for a preapproval VA home loan if I served in the National Guard or Reserves?

Yes, members of the National Guard and Reserves may be eligible for a preapproval VA home loan if they have completed at least six years of service. There are additional requirements based on the type of service, so it's important to consult the VA guidelines or speak with a VA-approved lender to determine your eligibility.

2. Is there an age limit for obtaining a preapproval VA home loan?

No, there is no specific age limit for obtaining a preapproval VA home loan. As long as you meet the other eligibility criteria, such as serving a minimum period of active duty and obtaining the required Certificate of Eligibility (COE), you can apply for a VA loan regardless of your age.

3. Can I use my VA home loan benefits more than once?

Yes, in most cases, you can use your VA home loan benefits more than once. However, there are certain conditions that need to be met, such as paying off the previous VA loan or selling the property. Your entitlement may also impact your ability to reuse your benefits, so it's important to consult with a VA-approved lender to understand your specific situation.

Comparing VA Loans to Conventional Loans

1. What are the advantages of a VA loan compared to a conventional loan?

One of the main advantages of a VA loan compared to a conventional loan is the ability to purchase a home with little to no down payment. Conventional loans typically require a down payment of at least 10%, whereas VA loans often allow eligible borrowers to buy a home with no down payment at all.

2. How does private mortgage insurance (PMI) differ between VA loans and conventional loans?

Private mortgage insurance (PMI) is usually required for conventional loans with a down payment of less than 20%. However, VA loans do not require PMI, which can save borrowers a significant amount of money over time.

3. Can I use a VA loan to purchase an investment property?

No, VA loans are intended for the purchase of primary residences only. You cannot use a VA loan to purchase an investment property or a vacation home. However, there are certain exceptions for multi-unit properties, as long as the borrower intends to live in one of the units.

Steps After Preapproval

Once you receive your preapproval for a VA home loan, there are still important steps to take to complete the homebuying process:

Find a Real Estate Agent

Working with a knowledgeable real estate agent who understands the VA loan process can greatly simplify your home search. Look for an agent who has experience working with veterans and service members and can help you find properties that meet your needs and budget.

House Hunting

With your preapproval in hand, you can start house hunting with confidence. Consider factors such as location, size, and amenities when searching for your dream home. Take your time and explore different options until you find a property that meets your requirements.

Make an Offer

Once you've found the perfect home, work with your real estate agent to make an offer. Your preapproval will strengthen your offer and demonstrate to the seller that you are a serious buyer. Negotiate terms and conditions with the seller until both parties reach an agreement.

Underwriting and Closing

After your offer is accepted, the loan will move into the underwriting process. During this stage, the lender will review your financial documents and conduct a final assessment of your loan application. Once the loan is approved, you can proceed to the closing process, where the necessary paperwork is signed, and the property officially becomes yours.

Enjoy Your New Home!

Congratulations! With the closing process complete, you can now enjoy your new home. Take pride in the fact that you have achieved homeownership with the help of a preapproval VA home loan. Make the space your own and create lasting memories in your new home.

In conclusion, a preapproval VA home loan is a fantastic opportunity for veterans and service members to achieve their dream of homeownership. From the benefits of no down payment and flexible credit score requirements to the step-by-step preapproval process and the importance of VA appraisals and inspections, this guide has provided a comprehensive overview of everything you need to know about preapproval VA home loans.

By understanding the eligibility requirements, comparing VA loans to conventional loans, and following the necessary steps after preapproval, you can navigate the process with confidence and secure a VA home loan that suits your needs and circumstances.

Remember to consult with a VA-approved lender and seek professional advice if needed. With the right knowledge and assistance, you can make your homeownership dreams come true with a preapproval VA home loan.

Comments

Post a Comment