- Get link

- X

- Other Apps

Are you struggling with overwhelming student loan debt? If so, you may have come across the term "student loan settlement offer." In this comprehensive guide, we will delve into the intricacies of student loan settlement offers, helping you understand what they are, how they work, and whether they are the right option for you.

Student loan settlement offers are agreements between borrowers and lenders that allow borrowers to settle their outstanding student loan debt for less than what they owe. This can be an enticing option for individuals facing financial hardship or those who are unable to make their monthly loan payments. However, before considering a settlement offer, it is crucial to understand the implications and consequences it may have on your credit score and financial future.

What is a student loan settlement offer?

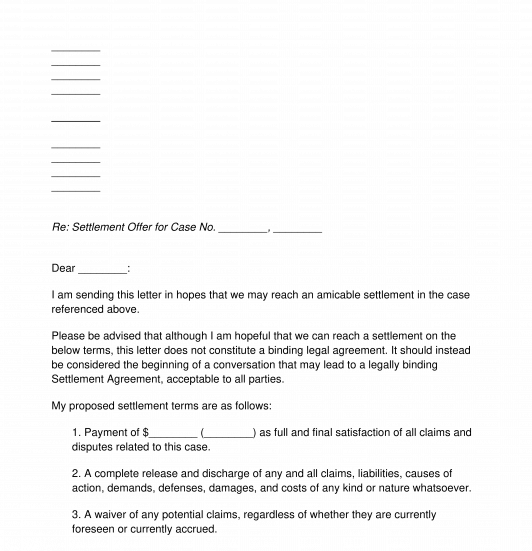

A student loan settlement offer is a negotiation between a borrower and a lender to resolve a student loan debt for a reduced amount. It differs from other debt relief options like loan forgiveness or forbearance, as settlement offers involve agreeing to pay a lump sum that is less than the total loan balance. To be eligible for a settlement offer, borrowers usually need to demonstrate financial hardship or a genuine inability to repay the loan in full.

Understanding the Difference from Loan Forgiveness and Forbearance

While loan forgiveness and forbearance are also options for managing student loan debt, it's important to understand how they differ from settlement offers. Loan forgiveness involves the cancellation of a portion or all of your student loan debt, usually after meeting specific criteria such as working in public service or teaching. On the other hand, forbearance allows borrowers to temporarily suspend or reduce their loan payments due to financial hardship, but interest may continue to accrue. Settlement offers, however, involve negotiating a lower payoff amount with the lender.

Eligibility and Requirements for Student Loan Settlement Offers

To qualify for a student loan settlement offer, borrowers often need to demonstrate financial distress, such as unemployment, underemployment, or significant medical expenses. Additionally, lenders may require borrowers to show that they have defaulted on their loans or are at risk of defaulting. Each lender may have specific eligibility criteria, so it's essential to contact your loan servicer or lender to inquire about their settlement offer options and requirements.

How do student loan settlement offers work?

The process of obtaining and negotiating a student loan settlement offer typically involves several steps. Understanding these steps can help you navigate the process more effectively and maximize your chances of securing a favorable offer.

Gathering Documentation and Assessing Financial Situation

Before initiating the settlement process, it's crucial to gather all relevant documentation, including loan statements, proof of income, and any evidence of financial hardship. This information will help support your case when negotiating with your lender. Additionally, take the time to assess your overall financial situation, including your income, expenses, and other outstanding debts, to determine if a settlement offer is the right solution for you.

Contacting Your Lender or Loan Servicer

Once you have gathered the necessary documents and assessed your financial situation, reach out to your loan servicer or lender to inquire about their settlement offer options. You may need to speak with a representative from the collections department or a specialized settlement team. Provide them with the required documentation and explain your financial hardship. Be prepared to answer questions about your income, assets, and expenses to assist in the negotiation process.

Negotiating the Settlement Offer

When negotiating a settlement offer, it's essential to approach the process with a clear understanding of your financial limitations and goals. Start by proposing a realistic settlement offer amount that you can afford to pay. Lenders may counteroffer or request additional information, so be prepared to provide further documentation or negotiate further. Remember, the goal is to reach a mutually beneficial agreement that allows you to settle your debt while also satisfying the lender's requirements.

Reviewing and Accepting the Offer

Once you and the lender have reached a settlement agreement, carefully review the terms and conditions of the offer before accepting it. Ensure that all the agreed-upon terms, such as the settlement amount, payment schedule, and any potential tax implications, are clearly outlined in writing. If you have any concerns or questions, seek clarification from the lender before finalizing the agreement. Once you are satisfied with the terms, accept the offer and proceed with making the agreed-upon payments to settle your student loan debt.

Pros and cons of student loan settlement offers

While student loan settlement offers can provide relief for borrowers struggling with their debt, it's important to consider the advantages and disadvantages before making a decision.

Advantages of Student Loan Settlement Offers

One significant advantage of a student loan settlement offer is the potential to reduce your overall debt burden. By negotiating a lower payoff amount, you may be able to save a substantial sum of money. Additionally, settling your debt can provide immediate financial relief, allowing you to regain control over your finances and potentially avoid more severe consequences, such as default or bankruptcy.

Disadvantages of Student Loan Settlement Offers

While settlement offers can be advantageous, they also come with potential drawbacks. One major disadvantage is the impact on your credit score. Settling a loan for less than the total balance can have negative effects on your creditworthiness, making it harder to secure future loans or obtain favorable interest rates. Additionally, forgiven debt may be considered taxable income, potentially resulting in a tax liability that you must address.

Considering Alternatives to Settlement Offers

Before pursuing a student loan settlement offer, it's crucial to explore alternative options that may better suit your financial situation. Loan consolidation, income-driven repayment plans, and loan forgiveness programs are just a few alternatives worth considering. These options can help you manage your student loan debt without facing the potential negative consequences associated with settlement offers.

How to qualify for a student loan settlement offer

Qualifying for a student loan settlement offer often requires meeting specific criteria set by your lender. Understanding these criteria can help you determine if you are eligible for a settlement offer and guide your approach in negotiations.

Demonstrating Financial Hardship

One of the primary eligibility requirements for a student loan settlement offer is proving financial hardship. This can include circumstances such as unemployment, underemployment, or significant medical expenses that make it challenging to meet your loan obligations. Providing documentation, such as pay stubs, medical bills, or unemployment records, can help support your case for a settlement offer.

Defaulting on Your Loans

Sometimes, lenders may require borrowers to be in default or at risk of defaulting on their loans to be eligible for a settlement offer. Default occurs when you fail to make payments for an extended period, typically 270 days or more. While defaulting may have negative consequences, it can also open up the possibility of negotiating a settlement offer as a means to resolve the debt.

Assessing Your Income and Expenses

Lenders often consider your income and expenses when evaluating your eligibility for a settlement offer. They may review your income sources, including wages, self-employment earnings, or government benefits, to assess your ability to make payments. Additionally, they may examine your monthly expenses to determine if you have the financial capacity to repay the loan in full or if a settlement offer would be a more viable solution.

The impact of student loan settlement offers on your credit score

When considering a student loan settlement offer, it's crucial to understand the potential impact on your credit score. While settlement offers can provide relief from debt, they may also have repercussions for your creditworthiness.

Understanding Credit Reporting and Settlement Offers

When you settle a student loan, the lender typically reports the settlement to the credit bureaus. This can result in a negative mark on your credit report, which can lower your credit score. The extent of the impact depends on various factors, such as your previous credit history, the size of the settlement, and how the lender reports it.

Rebuilding Your Credit After a Settlement Offer

If you choose to accept a settlement offer and experience a negative impact on your credit score, there are steps you can take to rebuild your credit over time. This may include making timely payments on any remaining debts, using credit responsibly, and monitoring your credit report for accuracy.

Seeking Professional Assistance for Credit Repair

If you're concerned about the potential impact of a settlement offer on your credit score, consider seeking professional assistance from credit counseling agencies or credit repair services. These professionals can provide guidance on rebuilding your credit and may offer strategies to mitigate the negative effects of a settlement offer on your creditworthiness.

Understanding the tax implications of student loan settlement offers

One aspect often overlooked when considering student loan settlement offers is the potential tax implications that may arise from the forgiven debt.

Forgiven Debt as Taxable Income

It's important to note that forgiven debt is generally considered taxable income by the Internal Revenue Service (IRS). When a lender forgives a portion of your student loan debt through a settlement offer, the forgiven amount is typically reported to you and the IRS on Form 1099-C. This means you may be required to include the forgiven debt as income on your tax return and potentially owe taxes on it.

Exceptions to Taxable Income

While forgiven debt is generally taxable, there are certain exceptions that may apply, allowing you to exclude the forgiven amount from your taxable income. For example, if you can prove that you were insolvent at the time the debt was forgiven, you may qualify for an insolvency exclusion. Additionally, certain loan forgiveness programs, such as those offered for working in certain professions or in specific areas, may have provisions that exempt the forgiven debt from taxation. It's important to consult with a tax professional or refer to IRS guidelines to determine if you qualify for any of these exceptions.

Preparing for Tax Consequences

When considering a student loan settlement offer, it's crucial to factor in the potential tax consequences. Settling a large amount of debt can result in a significant tax liability if you are unable to meet the criteria for any of the exceptions. It's advisable to consult with a tax professional to understand the potential tax implications and plan accordingly. They can help you estimate the tax liability and explore strategies to manage the tax burden, such as setting aside funds or adjusting your withholdings.

Common misconceptions about student loan settlement offers

Student loan settlement offers can be complex, and there are several misconceptions that can mislead borrowers. Understanding these misconceptions can help you make informed decisions about your student loan debt.

Settlement Offers Erase the Debt Completely

One common misconception is that student loan settlement offers completely erase the debt. While settlement offers may allow you to pay a reduced amount, it's important to understand that you will still be responsible for making payments. The settlement offer typically represents a negotiated lower sum that satisfies the lender and allows you to settle the debt without paying the full balance.

Settlement Offers are Guaranteed

Another misconception is that every borrower is guaranteed a settlement offer. The eligibility and approval for a settlement offer depend on various factors, including your financial circumstances, the lender's policies, and their assessment of your ability to repay the debt. It's important to approach the process with realistic expectations and be prepared to explore alternative options if a settlement offer is not feasible.

Settlement Offers Solve All Financial Problems

While settlement offers can provide relief from your student loan debt, they may not address all of your financial problems. It's essential to assess your overall financial situation and consider other debts, expenses, and financial goals. A settlement offer may provide temporary relief, but it's important to develop a comprehensive plan to address all aspects of your financial health.

Steps to take when considering a student loan settlement offer

When contemplating a student loan settlement offer, it's crucial to take certain steps to ensure you make an informed decision that aligns with your financial goals.

Assess Your Financial Situation

Start by thoroughly evaluating your financial situation. Calculate your income, expenses, and outstanding debts. Consider your short-term and long-term financial goals to determine if a settlement offer is the best option for you.

Research and Understand the Terms

Before initiating any discussions with your lender, research and familiarize yourself with the terms and conditions of settlement offers. Understand the potential impact on your credit score, tax consequences, and any other implications that may arise from accepting a settlement offer.

Explore Alternative Options

Consider alternative options such as loan consolidation, income-driven repayment plans, or loan forgiveness programs. These alternatives may better suit your financial situation and provide relief without the potential negative consequences associated with settlement offers.

Consult with a Financial Advisor or Credit Counselor

Seeking advice from a financial advisor or credit counselor can provide valuable insights into your specific situation. They can help you understand the pros and cons of settlement offers, explore alternative options, and guide you in making informed decisions regarding your student loan debt.

Negotiate in Good Faith

If you decide to pursue a settlement offer, approach the negotiation process in good faith. Be prepared to provide the necessary documentation, communicate openly with your lender, and propose a realistic settlement amount that you can afford. Remember, the goal is to reach a mutually beneficial agreement that allows you to settle your debt while satisfying the lender's requirements.

Seeking professional help with student loan settlement offers

Navigating the complexities of student loan settlement offers can be challenging, and seeking professional assistance can provide valuable guidance and support throughout the process.

Credit Counseling Agencies

Credit counseling agencies specialize in helping individuals manage their debt and develop effective strategies to regain financial stability. They can provide personalized advice, negotiate with lenders on your behalf, and help you explore alternative options to settlement offers.

Financial Advisors

Financial advisors can offer expert guidance on managing your student loan debt and creating a comprehensive financial plan. They can help you understand the implications of settlement offers, explore alternative strategies, and make informed decisions based on your individual financial goals.

Legal Professionals

If you encounter legal issues or have concerns about the settlement offer process, consulting with an attorney who specializes in student loan debt can provide valuable insights and guidance. They can review your situation, advise you on your rights and options, and assist in negotiating a favorable settlement offer, if applicable.

In conclusion, understanding student loan settlement offers is crucial for individuals burdened by student loan debt. By exploring the intricacies of settlement offers, considering alternative options, and seeking professional guidance, you can make informed decisions about your financial future. Remember to thoroughly assess your financial situation, negotiate in good faith, and consider the potential implications on your credit score and tax liability. With careful consideration and appropriate support, you can find the best path to tackle your student loan debt and regain control of your financial well-being.

Comments

Post a Comment