- Get link

- X

- Other Apps

When it comes to funding your education, finding the best interest rates for student loans is crucial. With the rising costs of tuition and other academic expenses, it's important to explore all your options to ensure you're making the most financially sound decision. In this comprehensive guide, we'll dive into the various lenders and institutions that offer student loans, comparing their interest rates and terms, so you can make an informed choice.

Before we delve into the specifics, it's essential to understand the impact that interest rates can have on your overall loan repayment. The interest rate determines how much you'll end up paying back in addition to the principal amount borrowed. Even a small difference in rates can lead to substantial savings or increased costs over the life of your loan.

Federal Student Loans

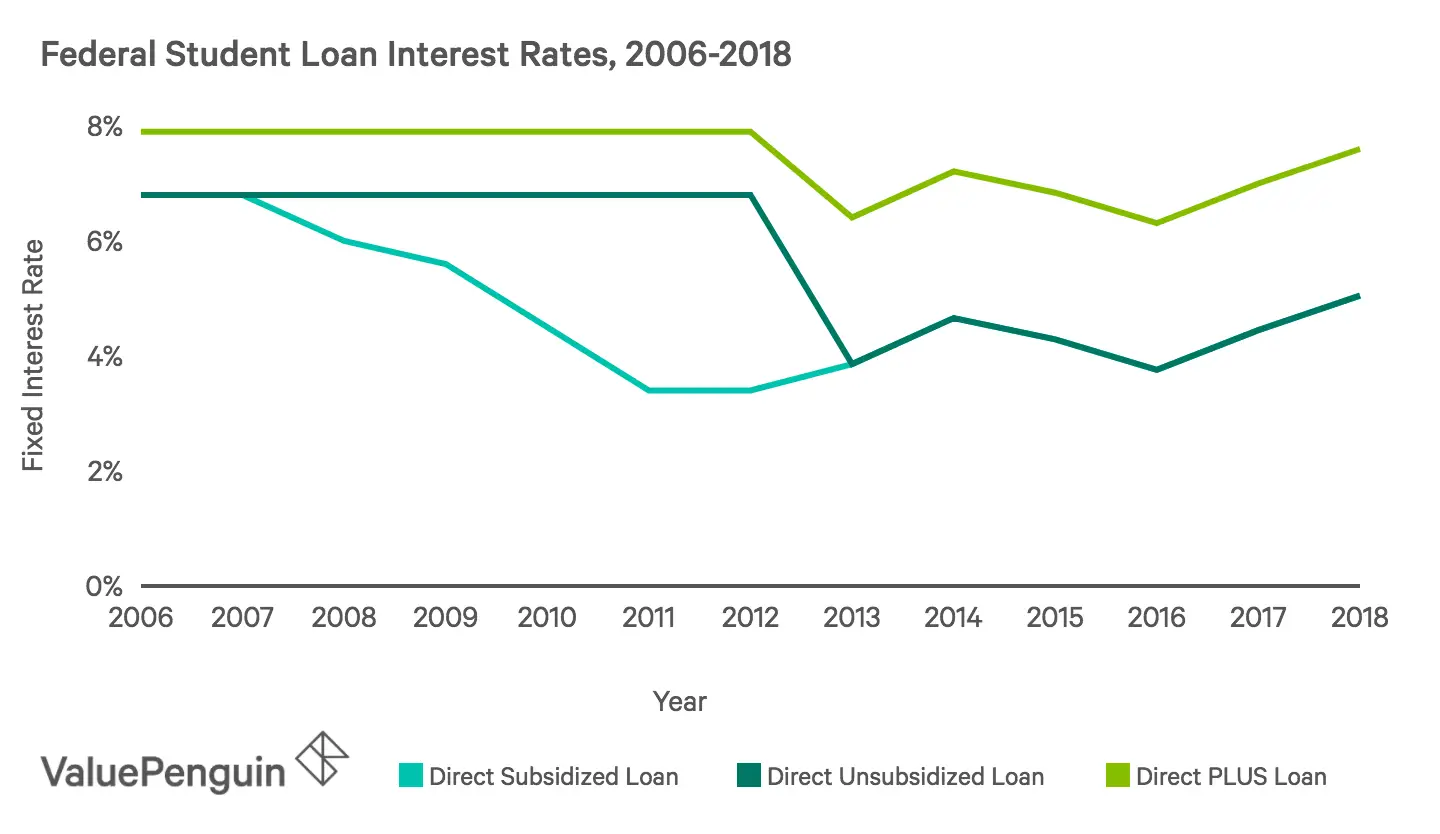

When it comes to student loans, federal loan programs are often considered the go-to option for many students due to their typically lower interest rates and more flexible repayment options. These loans are offered by the U.S. Department of Education and come with a variety of benefits. Let's explore the different types of federal student loans and their interest rates.

Direct Subsidized Loans

Direct Subsidized Loans are available to undergraduate students who demonstrate financial need. These loans have the advantage of the government paying the interest while you're in school, during the grace period, and during deferment. As of the 2021-2022 academic year, the interest rate for Direct Subsidized Loans is fixed at 3.73%.

Direct Unsubsidized Loans

Unlike Direct Subsidized Loans, Direct Unsubsidized Loans are available to both undergraduate and graduate students, regardless of financial need. However, unlike subsidized loans, interest on these loans begins accruing as soon as they are disbursed. For undergraduate students, the interest rate for Direct Unsubsidized Loans is currently fixed at 3.73%. Graduate students face a slightly higher interest rate of 5.28%.

Direct PLUS Loans

Direct PLUS Loans are available to graduate or professional students, as well as parents of dependent undergraduate students. These loans come with higher interest rates compared to subsidized and unsubsidized loans. For Direct PLUS Loans taken out by graduate or professional students, the interest rate is currently fixed at 6.28%. Parent borrowers face an interest rate of 6.28% as well.

Summary: Federal student loans offer a range of options with competitive interest rates. Depending on your financial need and academic level, you may qualify for Direct Subsidized Loans, Direct Unsubsidized Loans, or Direct PLUS Loans. Understanding the different types of federal loans and their associated interest rates is essential in making an informed decision about your education financing.

Private Lenders

While federal student loans are a popular choice, they may not always cover the full cost of education. In such cases, private lenders can provide an alternative source of funding. Private student loans are offered by banks, credit unions, and online lenders, and their interest rates can vary significantly depending on the lender and your creditworthiness. Let's explore the different aspects of private student loans and their interest rates.

Bank Loans

Many traditional banks offer student loans to borrowers who meet their credit requirements. Interest rates for bank loans can vary depending on several factors, including your credit score, income, and the type of loan you choose. It's important to shop around and compare rates from different banks to find the best deal. Typically, interest rates for bank loans can range from around 4% to 12% or higher, depending on the lender and borrower's creditworthiness.

Credit Union Loans

Credit unions are member-owned financial institutions that often offer lower interest rates compared to traditional banks. Their interest rates are usually more competitive because they aim to benefit their members rather than generate profits. If you're a member of a credit union, it's worth exploring the student loan options they provide. Interest rates for credit union loans can range from around 3% to 10% or higher, depending on various factors such as creditworthiness and the type of loan.

Online Lenders

The rise of online lenders has brought additional options for student borrowers. Online lenders typically have a streamlined application process and may offer competitive interest rates. These lenders often consider factors beyond just credit scores when determining interest rates, such as employment history and future earning potential. Interest rates for online lenders can range from around 3% to 15% or higher, depending on individual circumstances and the lender's terms.

Summary: Private lenders offer an alternative to federal student loans, but it's important to carefully consider their interest rates and terms. Banks, credit unions, and online lenders each have their own set of criteria for determining interest rates. Shopping around and comparing offers from different lenders can help you find the best interest rate for your private student loan.

Credit Unions

Credit unions are member-owned financial cooperatives that offer a wide range of financial services, including student loans. Many credit unions provide competitive interest rates and borrower-friendly terms, making them an attractive option for financing your education. Let's explore the benefits of credit unions and the interest rates they offer for student loans.

Membership and Eligibility

Unlike traditional banks, credit unions require membership to access their services. Membership eligibility varies from credit union to credit union, but it often includes individuals who live, work, or study in a particular geographic area or have a specific affiliation, such as being an employee of a certain organization or a member of a particular community group. Once you become a member, you can take advantage of the credit union's offerings, including student loans.

Competitive Interest Rates

One of the main advantages of credit unions is their ability to offer competitive interest rates on student loans. Credit unions are not-for-profit organizations, so they aim to provide their members with affordable financial products and services. This often translates into lower interest rates compared to traditional banks or online lenders. Depending on the credit union and the borrower's creditworthiness, interest rates for credit union student loans can range from around 3% to 8% or higher.

Additional Benefits

In addition to competitive interest rates, credit unions may offer other benefits to student borrowers. These benefits can include flexible repayment options, loan forgiveness programs, and financial education resources. Some credit unions also provide interest rate reductions for borrowers who set up automatic loan payments or demonstrate good academic performance. These additional benefits can help you save money and make your student loan repayment journey more manageable.

Summary: Credit unions are member-focused financial institutions that often provide student loans with competitive interest rates. By becoming a member, you can take advantage of their borrower-friendly terms and potentially save money over the life of your loan. Credit unions' commitment to their members' financial well-being sets them apart from traditional banks and online lenders.

Online Lenders

The digital age has revolutionized the lending industry, giving rise to online lenders that offer student loans with competitive interest rates. Online lenders provide convenience, efficiency, and often a simplified application process. Let's explore the benefits and considerations of borrowing from online lenders and the interest rates they offer.

Convenience and Accessibility

One of the main advantages of online lenders is the convenience they offer. You can complete the entire loan application process from the comfort of your own home, without the need for in-person meetings or paper documents. Online lenders typically have user-friendly websites and automated systems that make the borrowing experience more accessible and efficient. This can be particularly beneficial for busy students who prefer a digital approach.

Competitive Interest Rates

Online lenders often provide competitive interest rates on their student loans. They utilize advanced algorithms and data analysis to determine interest rates based on various factors, including credit history, income, and academic performance. Some online lenders also consider future earning potential when evaluating loan applications. Interest rates for online student loans can range from around 3% to 12% or higher, depending on individual circumstances and the lender's terms.

Considerations and Potential Drawbacks

While online lenders offer convenience and competitive interest rates, there are a few considerations to keep in mind. Some online lenders may have stricter eligibility criteria or require a cosigner, especially for borrowers with limited credit history. Additionally, it's important to thoroughly research and understand the terms and conditions of the loan, including repayment options, fees, and any potential penalties. Reading customer reviews and seeking recommendations can help you choose a reputable online lender.

Summary: Online lenders provide a convenient and accessible option for student loan borrowers. With competitive interest rates and streamlined processes, they offer an attractive alternative to traditional banks and credit unions. However, it's important to carefully evaluate the terms and conditions of online loans before committing, ensuring they align with your financial goals and needs.

State-Specific Loan Programs

In addition to federal and private loan options, many states offer their own loan programs specifically designed to assist local students. These state-specific loan programs often come with unique benefits and considerations. Let's explore these programs and the interest rates they offer.

Eligibility and Requirements

Each state has its own eligibility criteria and requirements for state-specific loan programs. These criteria may include residency, enrollment in an in-state institution, or meetingcertain academic or financial criteria. It's important to review the specific requirements of your state's loan program to determine your eligibility. Additionally, some state programs may have limited funding or be available on a first-come, first-served basis, so it's crucial to apply early and meet all application deadlines.

Interest Rates and Terms

State-specific loan programs often offer competitive interest rates. The interest rates can vary depending on the state and the specific program. Some states may offer fixed interest rates, while others may have variable rates tied to market conditions. It's important to carefully review the terms of the loan, including the interest rate, repayment options, and any applicable fees or penalties.

Additional Benefits and Resources

State loan programs may provide additional benefits and resources to borrowers. These can include loan forgiveness or repayment assistance programs for graduates who work in certain fields or underserved areas within the state. Some state programs also offer financial literacy resources and counseling services to help borrowers manage their student loans effectively.

Summary: State-specific loan programs can offer competitive interest rates and unique benefits to eligible students. By exploring these programs, you may find additional funding options and resources that can help you finance your education in a cost-effective manner.

Interest Rate Comparison Tools

Comparing interest rates from various lenders can be a daunting task. However, several online tools are available to simplify the process and assist you in finding the best interest rates for your student loans. Let's explore these interest rate comparison tools and how they can help you make an informed decision.

Loan Comparison Websites

Loan comparison websites allow you to input your loan requirements and receive a list of lenders with their corresponding interest rates and terms. These websites often provide filters and sorting options to help you narrow down your options based on your specific needs and preferences. They can save you time and effort by presenting all the relevant information in one place.

Financial Institution Websites

Many banks, credit unions, and online lenders have their own websites that provide information on their student loan offerings. These websites typically include interest rate calculators or comparison tools that allow you to input your details and receive personalized rate quotes. By visiting individual lender websites, you can directly compare interest rates from different institutions.

Government Websites

The U.S. Department of Education and other government agencies provide resources and tools to help you compare interest rates for federal student loans. These websites offer information on interest rates, repayment options, and loan forgiveness programs. By exploring these resources, you can gain a better understanding of the interest rates associated with federal loans and make informed decisions about your borrowing options.

Summary: Interest rate comparison tools, such as loan comparison websites and resources provided by financial institutions and government agencies, can streamline the process of finding the best interest rates for your student loans. Utilizing these tools can help you make informed decisions and potentially save money over the life of your loan.

Negotiating Interest Rates

Believe it or not, it's sometimes possible to negotiate interest rates with lenders, including both private lenders and federal loan servicers. Negotiating interest rates can potentially save you money over the life of your loan. Let's explore the art of negotiation and provide tips for students seeking to secure more favorable interest rates on their loans.

Research and Preparation

Before entering into negotiations, it's essential to research current interest rates and loan terms offered by various lenders. This information will provide you with a benchmark to compare and negotiate effectively. Additionally, gather any relevant documentation that showcases your creditworthiness, such as proof of income or academic achievements.

Be Polite and Professional

Approach negotiations with a polite and professional demeanor. Remember that lenders have the discretion to adjust interest rates within certain limits. Clearly communicate your desire to secure a lower interest rate and explain why you believe you deserve it, highlighting any positive factors that make you a reliable borrower.

Consider Multiple Options

If you're not satisfied with the interest rates offered by one lender, consider exploring other options. Having multiple offers in hand can give you leverage during negotiations. Don't be afraid to mention competing offers to demonstrate that you have alternatives and are actively comparing rates.

Consider a Cosigner

If you have a limited credit history or less-than-ideal credit score, having a cosigner with a strong credit profile can strengthen your negotiating position. A cosigner with excellent credit may help you secure a lower interest rate by providing the lender with additional confidence in your ability to repay the loan.

Be Flexible

While negotiating interest rates, it's important to be open to compromise. Lenders may not be able to meet your desired interest rate, especially if your creditworthiness or financial situation is less favorable. Consider alternative options, such as negotiating for other favorable terms, such as a longer repayment period or reduced fees.

Summary: Negotiating interest rates can be a worthwhile endeavor that may result in significant savings over the life of your loan. By conducting thorough research, maintaining a professional approach, and considering multiple options, you can increase your chances of securing a more favorable interest rate for your student loans.

Fixed vs. Variable Interest Rates

Choosing between fixed and variable interest rates is an important decision when taking out a student loan. Each has its advantages and considerations, and the choice depends on your individual circumstances and risk tolerance. Let's explore the differences between fixed and variable interest rates and discuss the factors to consider when making this choice.

Fixed Interest Rates

A fixed interest rate remains the same throughout the life of the loan. This means that your monthly payment and total interest paid are predictable, providing stability and allowing for easier budgeting. Fixed interest rates are typically higher than initial variable rates but can offer long-term cost savings if interest rates rise in the future.

Variable Interest Rates

Variable interest rates fluctuate over time, typically tied to an underlying benchmark such as the prime rate or the London Interbank Offered Rate (LIBOR). Variable rates often start lower than fixed rates but can increase or decrease depending on market conditions. This means that your monthly payment and total interest paid can vary, potentially increasing over time.

Risk Tolerance and Financial Stability

When choosing between fixed and variable interest rates, consider your risk tolerance and financial stability. If you prefer certainty and want to avoid any potential future interest rate increases, a fixed rate may be the better option. On the other hand, if you have a higher risk tolerance and anticipate interest rates to remain low or are confident in your ability to handle potential rate increases, a variable rate may provide initial cost savings.

Market Conditions and Economic Outlook

Consider the current market conditions and economic outlook when deciding between fixed and variable interest rates. If interest rates are historically low, choosing a fixed rate may be advantageous as it locks in a favorable rate for the life of the loan. Conversely, if interest rates are high or expected to decrease in the future, a variable rate may initially provide savings.

Loan Repayment Period

The length of your loan repayment period is another factor to consider. If you anticipate repaying your loan quickly, a variable rate may pose less risk as there is less time for significant interest rate fluctuations. On the other hand, if you expect a longer repayment period, a fixed rate can provide stability and protection against potential rate increases in the future.

Summary: Choosing between fixed and variable interest rates involves considering your risk tolerance, financial stability, market conditions, and loan repayment period. While fixed rates offer stability and predictability, variable rates can provide initial cost savings. Ultimately, the choice depends on your individual circumstances and preferences.

Interest Rate Reduction Programs

Some lenders offer programs that allow borrowers to reduce their interest rates through various means. These programs can help students save money over the life of their loan by providing opportunities to lower their interest rates. Let's explore some common interest rate reduction programs and how they can benefit borrowers.

Automatic Payment Discounts

Many lenders offer interest rate reductions for borrowers who set up automatic loan payments. By enrolling in automatic payments, you can typically receive a small percentage reduction in your interest rate, such as 0.25%. This reduction can lead to long-term savings and may even incentivize timely payments, as missing payments can result in the loss of the discount.

Good Academic Performance Discounts

Some lenders provide interest rate reductions for borrowers who maintain good academic standing. These programs reward students who achieve certain GPA thresholds or demonstrate academic excellence by reducing their interest rates. These reductions can provide additional motivation for students to excel academically while simultaneously saving money on their loans.

Loan Repayment Discounts

Certain lenders offer interest rate reductions for borrowers who make consistent, on-time payments over a specified period. These programs typically require a certain number of consecutive payments without any delinquencies or defaults. By meeting these requirements, borrowers can enjoy a reduction in their interest rate as a reward for responsible repayment behavior.

Debt Consolidation and Refinancing

Another way to potentially reduce interest rates is through debt consolidation or refinancing. By consolidating multiple loans into a single loan or refinancing your existing loan with a new lender, you may be able to secure a lower interest rate. This can resultin significant savings over the life of your loan. However, it's important to carefully consider the terms and fees associated with consolidation or refinancing, as well as any potential loss of benefits or protections offered by your original loans.

Loan Forgiveness and Repayment Assistance Programs

Some borrowers may qualify for loan forgiveness or repayment assistance programs offered by federal or state governments, as well as certain employers or organizations. These programs can provide partial or complete forgiveness of your loan balance, effectively reducing your overall interest rate. It's important to review the eligibility criteria and requirements of these programs to determine if you qualify and how they can benefit you.

Summary: Interest rate reduction programs can provide valuable opportunities for borrowers to lower their interest rates and save money over the life of their loans. Automatic payment discounts, good academic performance discounts, loan repayment discounts, debt consolidation or refinancing, and loan forgiveness or repayment assistance programs are just a few examples of the options available. By exploring these programs, you can potentially reduce the financial burden of your student loans.

Long-Term Strategies for Lowering Interest Rates

While finding the best interest rates initially is crucial, it's also important to consider long-term strategies for lowering interest rates over time. By implementing these strategies, borrowers can potentially save thousands of dollars in interest payments. Let's explore some actionable tips and strategies for lowering interest rates on student loans.

Building and Improving Credit

A strong credit score is essential for securing favorable interest rates. By building and improving your credit, you can potentially qualify for lower interest rates on future loans or even refinance your existing loans at a better rate. This can be achieved by making timely payments, keeping credit card balances low, and minimizing new credit applications.

Refinancing and Consolidating Loans

As mentioned earlier, refinancing or consolidating your loans can potentially lower your interest rates. By refinancing with a new lender or consolidating multiple loans into one, you may be able to secure a lower interest rate based on your improved creditworthiness or market conditions. It's important to carefully evaluate the terms, fees, and potential benefits before pursuing these options.

Making Extra Payments

One of the most effective ways to lower your interest costs is by making extra payments towards your principal balance. By paying more than the minimum required payment each month, you can reduce the overall amount of interest that accrues over time. Even small additional payments can make a significant difference in the long run.

Exploring Loan Forgiveness Programs

Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or income-driven repayment plans, can help borrowers reduce their overall interest costs. By working in certain qualifying professions or making payments based on your income, you may be eligible for loan forgiveness after a certain period. These programs can provide substantial savings for borrowers who qualify.

Staying Informed and Seeking Assistance

Lastly, staying informed about changes in the lending industry and seeking assistance when needed can help you navigate your student loan repayment journey. By keeping up with industry trends, you can identify opportunities to lower your interest rates, such as refinancing during periods of low market rates. Additionally, seeking assistance from financial advisors or loan servicers can provide valuable guidance and advice tailored to your specific situation.

Summary: Lowering interest rates on student loans is a long-term endeavor that requires proactive strategies and financial discipline. Building and improving credit, refinancing or consolidating loans, making extra payments, exploring loan forgiveness programs, and staying informed are all effective ways to potentially reduce interest costs and save money over the life of your loan.

Conclusion

When it comes to finding the best interest rates for student loans, there are numerous options to explore. Whether you opt for federal loans, private lenders, credit unions, or online lenders, each choice comes with its own set of advantages and considerations. By thoroughly researching and comparing interest rates, understanding the terms and conditions, and considering long-term strategies for lowering interest rates, borrowers can make informed decisions that align with their financial goals and ultimately minimize the burden of student loan debt. Remember, finding the best interest rates is just one piece of the puzzle; it's also important to borrow responsibly and manage your loans effectively throughout your academic journey and beyond.

Comments

Post a Comment